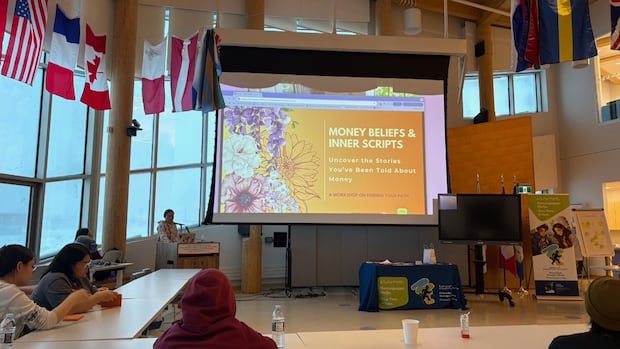

NorthA three-day camp last month hosted by the Makigiaqta Inuit Training Corporation aimed to promote financial literacy among young people.Young people in smaller communities can face barriers in setting up a bank accountBianca McKeown · CBC News · Posted: Dec 02, 2025 3:00 AM EST | Last Updated: 9 hours agoListen to this articleEstimated 4 minutesThe audio version of this article is generated by text-to-speech, a technology based on artificial intelligence.Financial educator Tupaarnaq Kopeck giving a lecture at a finance camp for youth in Cambridge Bay, Nunavut, last month. (Submitted by Tupaarnaq Kopeck)Juutai McKitrick from Coral Harbour, Nunavut, remembers how hard it was to set up his own bank account when he was younger. “My hometown doesn’t have street addresses. Like, the streets don’t have names, none of the addresses are registered,” he said. “Everyone does their mail through the P.O. box, and a lot of banks just don’t accept a P.O. box as a valid address.”He says he worked around this by putting in a non-registered address. But McKitrick says that’s just one example of the barriers Inuit can face when setting up a bank account.Last month, he helped teach financial literacy to youth at a three-day camp hosted by the Makigiaqta Inuit Training Corporation in Cambridge Bay. Financial educator Tupaarnaq Kopeck was also involved. She says she noticed some kids who attended the camp from smaller communities didn’t have their own bank accounts, but were eager to learn more. “A lot of the stuff I’m teaching, it would be good for them to actually go back home and use these teachings in real life,” Kopeck said. “But, they were not able to do that because they don’t have a bank account.” Financial educator Tupaarnaq Kopeck at the Makigiaqta finance camp for youth in Cambridge Bay in early November. (Submitted by Tupaarnaq Kopeck)Not having a bank account is called being “unbanked” and in 2015, Prosper Canada estimated that 15 per cent of Indigenous people in Canada were unbanked, compared to two per cent of the total Canadian population. In Nunavut, larger cities like Iqaluit have several bank branches, while smaller communities in the territory have one bank or no banks at all. McKitrick says it’s important to teach financial literacy because it benefits the entire community, not just the individual. “If there’s banking services and then someone is able to use those services to open a business within the town, that’s extra amenities,” he said. “Not just benefit for the person making the money, it’s benefit for the people that are visiting their store or their shop.” McKitrick says he’s been advocating for more accessible banking by pushing municipalities to register street addresses and looking into having banking services available at the post office.WATCH | Cambridge Bay youth learn to navigate Nunavut’s banking woes:Cambridge Bay youth learn to navigate Nunavut’s banking woesBanking with a P.O. box? Don’t have a street address? This can make getting a bank account harder. Nunavummiut face some unique challenges with banking. The CBC’s Bianca McKeown has more. Online optionsKathleen Gomes branch manager of the First Nations Bank in Iqaluit, says they opened their Igloolik branch last year to make banking accessible in that community. She says even if there is no physical bank in a community, people can still open accounts online. “If they’re not computer savvy, let’s say, they can always call the branch and speak to a financial service manager or even myself,” Gomes said. RBC said in a statement that it’s committed to financial education reaching young people where they are and that resources are available online. CIBC also said in a statement that it offers “remote meeting options” for clients who can’t visit in-person banking locations. As for Kopeck, her advice for young people who don’t have a bank branch in their community is to look online and don’t be afraid to ask for help. “There is lots that they can do on their own at home, on their computer,” she said. “Another thing that we have to all be better at is just also asking someone. If there is someone in your community that you know is really good with money, just ask them.” ABOUT THE AUTHORBianca McKeown is a reporter with CBC North in Iqaluit. Previously, she worked at CBC Ottawa. Have a story idea? Email her at: bianca.mckeown@cbc.ca

Thursday, 5 Mar 2026

Canada – The Illusion

Search

Have an existing account?

Sign In

© 2022 Foxiz News Network. Ruby Design Company. All Rights Reserved.

You May also Like

- More News:

- history

- Standing Bear Network

- John Gonzalez

- ᐊᔭᐦᑊ ayahp — It happened

- Creation

- Beneath the Water

- Olympic gold medal

- Jim Thorpe

- type O blood

- the bringer of life

- Raven

- Wás’agi

- NoiseCat

- 'Sugarcane'

- The rivers still sing

- ᑲᓂᐸᐏᐟ ᒪᐢᑿ

- ᐅᑳᐤ okâw — We remember

- ᐊᓂᓈᐯᐃᐧᐣ aninâpêwin — Truth

- This is what it means to be human.

- Nokoma