Politics·BreakingIn a scathing new report released Tuesday, the auditor general found Canada Revenue Agency contact centres are repeatedly failing to answer calls in a timely manner, and when agents do connect to a customer, they are often providing inaccurate responses.In test calls, CRA agents gave accurate answers only 17% of the time when asked about individual taxesJohn Paul Tasker · CBC News · Posted: Oct 21, 2025 10:07 AM EDT | Last Updated: 8 minutes agoIn her latest report, Auditor General Karen Hogan, shown here on June 10, found Canada Revenue Agency contact centres are repeatedly failing to answer calls in a timely manner. (Sean Kilpatrick/The Canadian Press)In a scathing new report released Tuesday, the auditor general found Canada Revenue Agency contact centres are repeatedly failing to answer calls in a timely manner — and when agents do connect to a customer, they are often providing inaccurate responses.While the CRA has committed to answering 65 per cent of calls within 15 minutes — a standard that is already much lower than it was in the past — Auditor General Karen Hogan found that just 18 per cent were answered in that time frame in 2024-25. In June, the service offered was even worse: fewer than five per cent of calls were answered within 15 minutes.The AG’s office placed 167 test calls to the CRA between February and May of this year to assess the agency’s promised response time — the average wait time to reach an agent was nearly 33 minutes. Between time on hold and spent with an agent, the report said it took analysts about 50 minutes on average to get an answer to a query.That aligns with the CRA’s own data, which shows it took 31 minutes on average to reach an agent for the tens of millions of callers each year — twice the time it took the year before and a sign that standards are slipping and service is getting worse. CRA call centres also deflected some 8.6 million calls last year, which means many customers were not even given the option to speak to an agent. That figure is a lot higher than the 1.4 million calls that were deflected the year prior.As a result, customer complaints about the CRA have soared with the auditor general finding a 145 per cent spike between 2021-22 and 2024-25, despite the agency’s claim that some 77 per cent of callers who answer a survey are “satisfied” with their experience.The AG is recommending the CRA figure out a better system to triage calls related to issues with the agency’s online portal, MyAccount. Many calls are related to being locked out of that digital system and its tying up agents, the report found.Information from CRA often inaccuratePerhaps the auditor general’s most troubling finding is that tax-filers are often getting inaccurate information from CRA agents.The auditor general’s office assessed the quality of the test calls it placed and found only 17 per cent of the answers provided to non-account-specific or general questions about individual taxes were accurate — and those sort of calls make up about one-fifth of all calls answered by agents. The answers to questions about benefits and business taxes were better, but CRA agents still barely received a passing grade, with 56 and 54 per cent of those respective calls determined by the auditor general to be accurate.The AG found that the CRA spent little time or effort on improving the accuracy: there was just 2,200 hours of coaching, feedback or training in 2024-25, which is under 30 minutes per agent annually.The auditor general also found that the CRA is not getting the full value of its contract with IBM, which handles the telephony services. When AG analysts dialled through to test the system, they were not provided with the expected real-time updates on their queue position, which left callers waiting with no idea how long it would be before reaching an agent.”Canadians are trusting the Canada Revenue Agency to provide answers to their tax and benefit questions that are accurate and complete. Errors in taxes and missed deadlines can be costly to taxpayers,” Hogan said. Military recruiting, water advisories also highlightedThe AG also released performance audits Thursday on recruiting for Canada’s military, the early learning and child-care systems, cyber security and a number of First Nations programs.Notably, the auditor general found that while the number of applicants to the Canadian Armed Forces has been up in recent years, the military is having trouble turning those applicants into recruits.The military planned to recruit some new 19,800 CAF personnel last year but brought in only about 15,000, which the auditor general said could be because the recruitment period is often 200-300 days long, well above target, and there’s a huge backlog with pending security checks.The AG also found that the military’s housing system is performing poorly. In the spring, there were only 205 residential housing units available to CAF members, while there were 3,706 applicants on wait lists. She found that while the vast majority of CAF personnel waiting for a residential unit were singles, there are few one- or two-bedroom units among the housing stock.The AG also checked in on progress made by Indigenous Services Canada after her past reports found inadequacies with a number of programs.Hogan found that while progress has been made on lifting long-term drinking water advisories in effect on some First Nations communities, the Liberal government has so far failed to meet former prime minister Justin Trudeau’s decade-old commitment to lift all of them. As of April 1, there are still 35 such advisories in place, the AG found. As for addressing nursing shortages on reserve, the AG has found higher pay and benefits have attracted more of these health-care workers than before, but there are still relatively high vacancy rates.With respect to the federal government’s $10-a-day child care program, Hogan found that costs are approximately $16.50 a day nationwide, and five provinces and three territories have already met the lower target. The governments, however, have been slow to create low-cost spaces with just 112,000 created so far and just two years left to stand up the promised 250,000 within five years.ABOUT THE AUTHORJ.P. Tasker is a journalist in CBC’s parliamentary bureau who reports for digital, radio and television. He is also a regular panellist on CBC News Network’s Power & Politics. He covers the Conservative Party, Canada-U.S. relations, Crown-Indigenous affairs, health policy and the Senate. You can send story ideas and tips to J.P. at jp.tasker@cbc.caFollow J.P. on X

Wednesday, 4 Feb 2026

Canada – The Illusion

Search

Have an existing account?

Sign In

© 2022 Foxiz News Network. Ruby Design Company. All Rights Reserved.

You May also Like

- More News:

- history

- Standing Bear Network

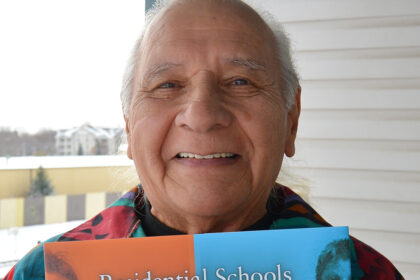

- John Gonzalez

- ᐊᔭᐦᑊ ayahp — It happened

- Creation

- Beneath the Water

- Olympic gold medal

- Jim Thorpe

- type O blood

- the bringer of life

- Raven

- Wás’agi

- NoiseCat

- 'Sugarcane'

- The rivers still sing

- ᑲᓂᐸᐏᐟ ᒪᐢᑿ

- ᐅᑳᐤ okâw — We remember

- ᐊᓂᓈᐯᐃᐧᐣ aninâpêwin — Truth

- This is what it means to be human.

- Nokoma